Following up (as promised) on our last article titled “Gift City Explained”, and another informative article written by the author titled “GIFT City: A Hub for Alternative Investment Funds”, we are back with our second article providing an in-depth practical understanding of Alternative Investment Funds in GIFT City. Fund Management Entities in GIFT City have ample number of choices to launch their first scheme in the IFSC depending on several factors which including the corpus of the scheme, investee entities, and investor types. This article aims to give the readers a comprehensive understanding of what these schemes are and how a new FME can establish their first scheme in GIFT City. Let us get into it.

Venture Capital Schemes (“VCS”) are designed to channel investments into nascent and high-growth enterprises. They are filed with the IFSCA as “venture capital funds” under Category I Alternative Investment Fund, a classification that extends to their treatment under the Income Tax Act, 1961, and Foreign Exchange Management Act (“FEMA”) and also includes Angel Fund.

A VCS shall only be a close ended scheme (close ended scheme means a scheme which takes contribution only once with a pre-determined maturity date) and may be constituted in the form of Company / LLP / Trust.

The tenure of a VCS cannot be less than three (3) years extendable up to two (2) years, with approval of two-thirds (2/3rd) of the investors by value. Any further extension beyond two (2) years shall be subject to express consent of the willing investors and exit opportunity being made available to the dissenting investors. (5)

A VCS may invest in India, IFSC or a foreign jurisdiction in the following instruments – unlisted securities; securities listed or to be listed or traded on stock exchanges; money market instruments; debt securities; securitized debt instruments, which are either asset-backed or mortgage-backed securities; units of other venture capital schemes (disclosure mandatory); Units of retail schemes and restricted schemes or alternative investment funds (disclosure mandatory); limited liability partnerships.

VCS can be launched through private placement by filing a placement memorandum with IFSCA. A significant feature is the “green channel” process, which allows schemes to be open for investor subscription immediately upon IFSCA communicating that the placement memorandum has been taken on record. The memorandum remains valid for 12 months, during which the FME must achieve the minimum corpus of USD 3 million. A one-time 6-month extension is possible if the minimum corpus is not met, subject to payment of a 50% delay fees as required for filing a placement memorandum.

The minimum corpus for VCS is USD 3 million, with a maximum of USD 200 million.

A VCS cannot have more than fifty (50) investors. Investors committing at least USD 250,000 and accredited investors (definition of accredited investors as specified by IFSCA can be found here) are allowed to make investments in VCS. For FME employees, directors, or designated partners, the minimum investment is lowered to USD 60,000. Joint investments are permitted, with specific rules for spouses, parents, and children, ensuring a total investment of at least USD 250,000 for such joint categories.

The FME (or its associate) must contribute to the scheme. For targeted corpus up to USD 30 million, the contribution is at least 2.5% but not exceeding 10% of the corpus. For corpus over USD 30 million, it’s at least USD 750,000 but not exceeding 10%. This contribution is not mandatory for relocated schemes (established outside India to IFSC) or if the FME/associate are non-residents with no Indian ultimate beneficial owners and less than one-third of the corpus is invested in an associate investee company. Contributions must be made within 45 days and maintained, with extensions possible. This “skin in the game” can count towards the FME’s net worth requirements.

Restricted Schemes (Non-Retail)

Restricted Schemes may be launched by Registered FMEs (explained in our recent article) and cater to a broader range of investment strategies. They can be categorized as Category I, II, or III AIFs based on their investment focus.

A Restricted Scheme may be open ended or close ended and may be incorporated in the form of a Company / LLP / Trust.

In case of a close ended restricted scheme, the tenure shall not be less than one (1) year extendable up to two (2) years with approval of two-thirds (2/3rd) of the investors by value. Further extension to the tenure of a close ended restricted scheme is subject to express consent of the willing investors and exit opportunity being made available to the dissenting investors.

In addition to VCS permitted investments, Restricted Schemes are allowed to invest in derivatives including commodity derivatives (disclosure mandatory). Furthermore, a close ended scheme may invest up to twenty per cent. (20%) of the corpus in physical assets such as real estate, bullion, art or any other physical asset prescribed by IFSCA.

Similar to VCS, Restricted Schemes are filed via a placement memorandum under the “green channel”, allowing immediate investor subscription upon IFSCA communication.

A restricted scheme must have a minimum corpus of USD 3 million, though it can start operations with at least USD 1 million provided it reaches the minimum within 12 months of approval. In an open-ended scheme, investment in unlisted securities cannot exceed 25% of its total corpus, except in the case of a fund of funds investing in other open-ended schemes that themselves follow this 25% cap. Such schemes can invest in their associates only with prior consent from 75% of investors by value, and they cannot buy or sell securities to associates, related schemes, or investors holding 50% or more of the corpus without similar approval (excluding the concerned investor from voting). However, this restriction does not apply to fund of funds schemes if full disclosure about the underlying schemes and associations is made in the placement memorandum.

A Restricted Scheme cannot have more than thousand (1,000) investors. Investors committing at least USD 150,000 and accredited investors (definition of accredited investors as specified by IFSCA can be found here) are allowed to make investments in the scheme. For FME employees, directors, or designated partners, the minimum investment is lowered to USD 40,000. Joint investments are permitted, with specific rules for spouses, parents, and children, ensuring a total investment of at least USD 150,000 for such joint categories.

For close-ended schemes, the FME/associate contribution is similar to VCS (2.5% – 10% or minimum USD 750,000). For open-ended schemes, it is at least 5% but not exceeding 10% for corpus less than USD 30 million, or at least USD 1,500,000 but not exceeding 10% for corpus over USD 30 million. Exemptions and waiver conditions are similar to VCS.

Retail schemes are launched by Registered FMEs (Retail) to pool money from all investors or a section of investors through an offer document for investment as per a stated investment objective. Retail scheme means a scheme offered to all investors or a section of the investors for subscription with no ceiling as to number of investors in the scheme.

Retail schemes may be launched as either open-ended or close-ended. They can be constituted in the form of a Company, LLP, or Trust.

Same as Restricted Schemes

Same as Restricted Schemes excluding physical assets as provided for close ended restricted schemes.

A retail scheme scheme may be launched only after twenty one (21) working days of submission of a draft offer document along with applicable to IFSCA. The validity of the offer document for launch of the scheme shall be twelve (12) months from the date of communication from the Authority to the FME that the offer document has been taken on record.

Retail schemes must have a minimum corpus of USD 3 million, though open-ended schemes may start with at least USD 1 million, provided they achieve the minimum within 12 months of approval, with a one-time option to extend this period by 6 months on payment of applicable fee.

Retail schemes shall have at least twenty (20) investors with no single investor investing more than twenty five per cent. (25%) in a scheme.

The FME/associate contribution is at least 1% of AUM of the scheme or USD 200,000 whichever is lower. Exemptions and waiver conditions are similar to VCS.

Apart from these three categories, the Fund Management Regulations also provide requirements for Special Situation Funds, Exchange Traded Funds, and Portfolio Management Services provided by the FMEs. We will delve into these topics in future articles along with getting into the intricacies of third-party fund management services as discussed in this article.

How to Register an AIF in GIFT City?

As per the guidelines provided under IFSCA Circular dated April 05, 2024 available here, application form(s) and the annexures thereunder should be sent electronically at applications@ifsca.gov.in, with copies marked to mihir.upadhyay@ifsca.gov.in, singh.jasmeet@ifsca.gov.in, singh.kanika@ifsca.gov.in, and jain.p@ifsca.gov.in. Readers are advised of the following points:

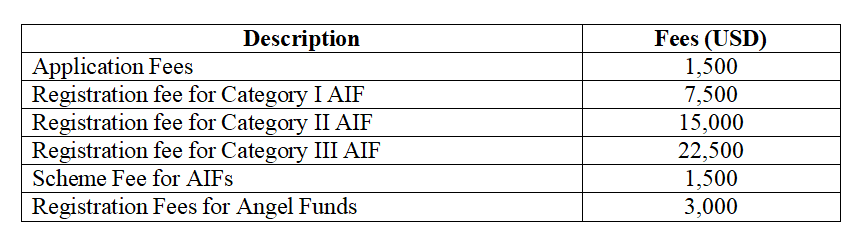

Fee Structure for Launching Schemes

Note: This article is intended solely for general informational purposes and does not constitute legal, financial, or investment advice. Readers are advised to consult with qualified legal and financial professionals before making any decisions based on the information provided herein.

Mr. Akshay is a corporate lawyer hailing from Campus Law Centre, University of Delhi specializing in M&A, PE and VC transactions. He also advises Companies and LLPs on legal compliance and intellectual property protection