SEBI’s 210th Board Meeting (June 2025) would act as a precursor to one of the biggest overhauls of the angel investing lansdcape in India. The Board has in its meeting approved the proposal to mandate that all investors in Angel Funds must now be “Accredited Investors”. This move marks a pivot away from the old, self-declared status of “Angel Investor” to a formalized, independently verified classification.

What is the Reason for the Proposed Amendment?

The previous framework, which defined an “Angel Investor,” was established in 2013. While it served its purpose at the time, it had become increasingly inadequate in the face of a rapidly maturing and expanding startup ecosystem. The core problems were two-fold, as detailed in SEBI’s press release :

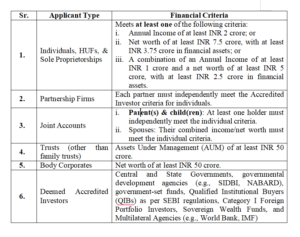

Who are Accredited Investors?

Note: The criteria for individuals, HUF, and sole proprietorship explicitly excludes the value of their primary residence.

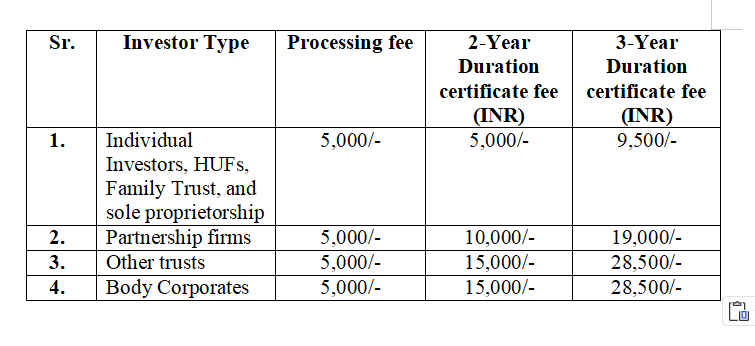

How does an Investor become an Accredited Investor?

The process of becoming an Accredited Investor has been streamlined to make it efficient and verifiable. The responsibility of this process falls on specialized entities known as Accreditation Agencies. The process for a prospective investor to become an Accredited Investor is predominantly digital and involves several distinct steps:

Can Angel Funds verify if an Investor is Accredited?

Once the proposed amendment becomes the norm, all investors in an Angel Fund will have to be accredited which makes it important for the Fund (“Investment Provider”) to be able to verify the certificates issued to the investor before giving them the benefits attached with accreditation. This makes it important for Investment Providers to also register themselves with the Accreditation Agency to be able to verify the authenticity of the issued certificates.

As per Clause 4.18.4 of the extant Accreditation framework, “investment provider shall verify directly from the Accreditation Agency that the certificate furnished by the prospective investor is indeed issued to that particular investor and accreditation status corresponding to the specific certificate number is valid as on the date of verification. The investment provider shall ensure that the prospective investor has a valid Accreditation Certificate before entering into a client agreement offering benefits linked to accreditation.”

Impact on the Angel Fund Lanscape

SEBI’s decision to mandate Accredited Investor status for all investors in Angel Funds is a pragmatic and strategically nuanced step forward for the Indian financial ecosystem. It replaces a flawed, self-attested system with a standardized and independently verifiable framework, fundamentally enhancing investor protection and market transparency. This move balances the dual objectives of safeguarding investors and fostering the growth of the startup ecosystem. However, with the current criteria to qualify as an accredited investor being extremely steep, such a mandate might lead to investors and fund managers to think twice before considering angel fund as their preferred fund structure.

Note: This article is intended solely for general informational purposes and does not constitute legal, financial, or investment advice. Readers are advised to consult with qualified legal and financial professionals before making any decisions based on the information provided herein.

Mr. Akshay is a corporate lawyer hailing from Campus Law Centre, University of Delhi specializing in M&A, PE and VC transactions. He also advises Companies and LLPs on legal compliance and intellectual property protection.